Annual Brief

Conflict, Climate & Recovery Global Trade in a Complex and Contested World 2022

Share this page

Trade is in a gloomy state

Trade policy is in a gloomy state. Rarely have geopolitics have had such a significant impact on global trade than in 2022. This year trade will be book-ended by the conflict in Ukraine and the shockwaves that have reverberated through the global trade system as a result. Europe and the US have engaged in an unprecedented economic warfare, effectively turning globalisation and the global trading environment against Russia, ostracising it from global markets with big geopolitical ramifications. In addition, record high inflation, soaring energy costs, an enduring pandemic combined with

significant ongoing supply chain disruptions has led economists to revise down economic growth predictions for the world. However, despite these challenges, real world trade volumes are positive and trending in the right direction. The World Trade Organisation’s (WTO) revised statistics for 2021 measured global trade at $22.28 trillion, far exceeding pre-pandemic trade values.

National Security as glue for transatlantic cooperation

One silver lining in context of the war in Ukraine: transatlantic cooperation between the US and its European partners has greatly increased. After years of tension and gloomy predictions over the state of transatlantic relations, partners have rediscovered the need for transatlantic alignment and strength. In fact, the conflict in Ukraine is fuelling closer transatlantic cooperation on sanctions, semi-conductors, strategic goods, and energy supplies. National security serves as the new glue for transatlantic cooperation. In other words, national security is defining the new terms of global trade cooperation.

Energy Policy and Supply Chains high on the political agenda

Fuelled by the repercussions from the war in Ukraine, energy policy and supply chain policy have been pushed even higher up on the political agenda. Western partners have re-discovered the need to use and build economic alliances to confront war and aggression. The question, however, will be as to what limits that strategy holds. Can European countries decrease their energy dependence on Russia? Would the Western world be able to apply similar sanctions on China should it decide to invade Taiwan? How will China position itself vis-a-vis the escalating conflict in Ukraine? When and under which circumstances would the Western world be able to lift sanctions in Russia?

A more proactive US Trade Policy Agenda

For the first 18 months in the new Administration, US Trade Policy has largely focused on a) solving ongoing trade disputes, primarily with Western allies, such as the aircraft subsidy conflict or the Section 232 conflict over trade in steel and aluminium, and b) the creation of a new trade narrative around a ‘worker’s economy’. Yet, with exception of the creation of the US-EU Trade and Technology Council (TTC), no major new trade initiative has been launched since the formal trade talks between the US and the UK and the Phase 1 +2 negotiations with China under the previous Administration. The new national security angle to trade, the successful resolution of pending trade disputes and future changes in the political landscape, however, may lead to a much more proactive US trade policy. The US’ approach to China, however, has yet to be solved.

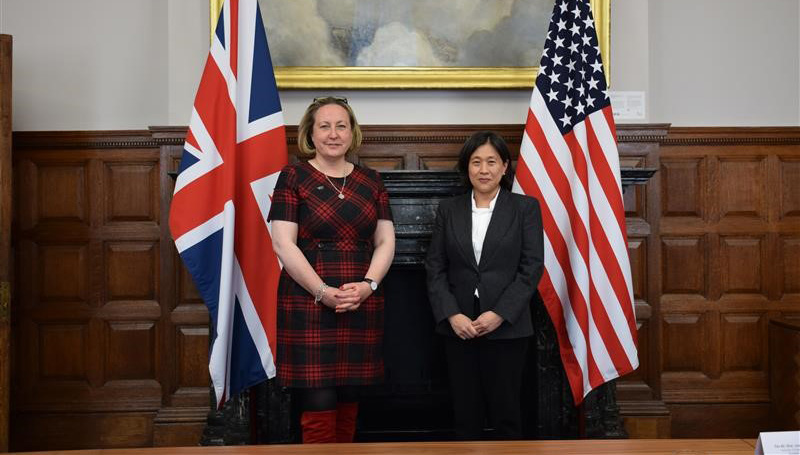

US-UK Dialogue on the Future of Transatlantic Trade

A recent example of a more proactive US Trade Policy is the establishment of the US-UK Dialogue on

the Future of Transatlantic Trade. These dialogues, the first of which was held in March, are part of

the administration’s efforts to shore up its relationship with key allies, such as the UK. They may also

be understood as a platform to help promote a new narrative of an inclusive, fair, climate friendly,

sustainable, rules based global economy for the 21st century. How this new narrative can find its way

into formal trade agreements or any other forms of trade arrangements has yet to be seen.

The end to the era of globalisation as we know it?

The layering effects of geopolitics forces companies to re-think and re-assess supply chain resiliency and risks as the combination of these simultaneous issues can cause significant business disruption. Corporations may have to adjust to pervasive, sustained uncertainty, consider significant inflationary pressures, high energy costs and large adjustments in commodity prices. In addition, companies may have to think around and adjust their supply chains and operations to accommodate a potential shift to trading with only other like-minded partners who share our economic values or regional trading blocks that guarantee a level playing field on trade.

WTO – Reform Needed More than Ever

Despite the likelihood of a more regional approach to trade, the need for the WTO and multilateral platforms to regulate trade is greater than ever, in part as a means to find common ground with super powers such as China and India. The WTO is a vitally important organisation to the maintenance of the rules-based order. It requires fundamental reform but still serves a central role in governing global trading frameworks and in limiting and reducing tensions between members.

This Annual Brief reflects the contributions made by panellists Speakers at BAB’s Annual Global Trade & geopolitics Update: Conflict, Climate & Recovery – Global Trade in a Complex and Contested World, help on Tuesday, 5th April 2022, and organised as part of the AIG Global Trade Series.

Panellists included Marianne Schneider-Petsinger, Senior Research Fellow, Chatham House; Jennifer Hillman, Professor of Practice, Georgetown Law Center; Rem Korteweg, Head of “Europe in the World”, The Clingendael Institute; Prof. Simon Evenett, International Trade & Economic Development, University of St. Gallen. The session was moderated by Duncan Edwards, CEO BritishAmerican Business.

Annual Brief produced by Michael Haddadeen. Input by Emanuel Adam and Dagny Ahrend